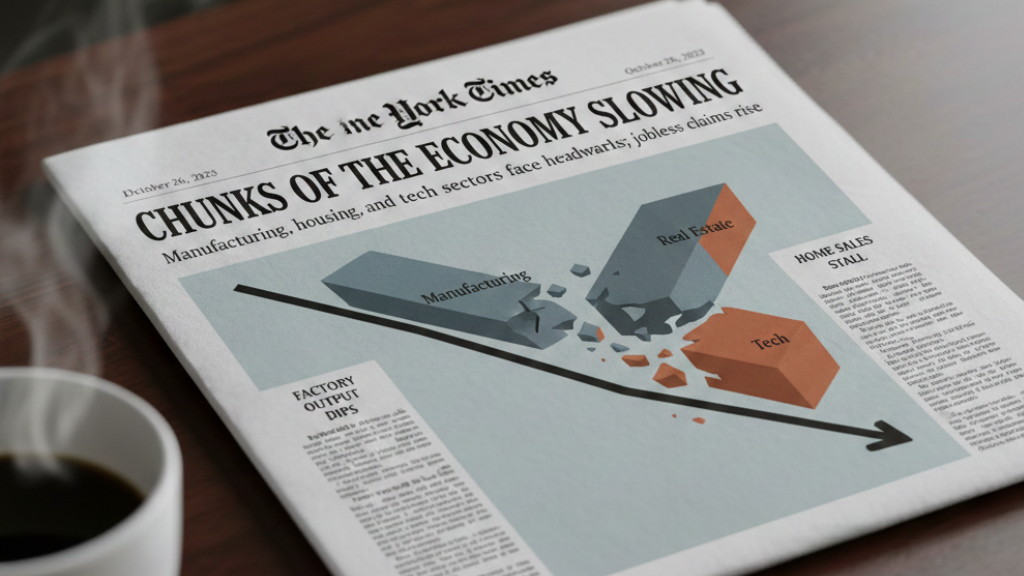

The modern financial landscape is no longer a single, cohesive engine. Instead, it has transformed into various chunks of the economy nyt columnists and financial experts often describe as a “K-shaped” or fragmented reality. To understand why some sectors are booming while others face “grave peril,” we have to look at the individual pieces of the puzzle. From the rapid rise of artificial intelligence to the cooling of traditional retail, the way we produce, spend, and invest has shifted into distinct silos that often operate under entirely different sets of rules.

- Mapping the Major Chunks of the Economy NYT

- The “Perpetual Motion Machine” and Economic Friction

- How AI is Redefining Economic Chunks

- Trade Wars and the “Hydra” of Supply Chains

- The Role of Private Credit and Shadow Banking

- Consumer Sentiment in a Fragmented Economy

- Conclusion: Navigating the Chunks

- Frequently Asked Questions (FAQs)

Mapping the Major Chunks of the Economy NYT

When we talk about the different chunks of the economy nyt, we are essentially looking at how different industries react to global stressors like inflation, technological disruption, and policy shifts. In 2026, the divide between “old world” manufacturing and the “new world” of digital assets has never been more pronounced.

-

The Technology and AI Chunk: This is currently the most aggressive driver of growth. Companies specializing in large language models and semiconductor manufacturing have carved out a massive portion of market capitalization.

-

The Service and Hospitality Sector: Often referred to as the “spending engine,” this chunk relies heavily on the “one person’s spending is another person’s income” philosophy.

-

The Financialization Segment: A growing and controversial chunk that includes private equity and “shadow banking,” which often operates with less transparency than traditional commercial banks.

-

The Industrial and Manufacturing Base: This sector is currently navigating the “Hydra” of trade disruptions and supply chain shifts.

The “Perpetual Motion Machine” and Economic Friction

A core concept often highlighted in the New York Times is that a capitalist economy is a “perpetual motion machine.” We buy what we need, providing income to producers, who then spend that money elsewhere. However, when we look at specific chunks of the economy nyt, we see that this motion is starting to catch.

For instance, the over-financialization of the U.S. economy has led to a scenario where we have more private equity firms than fast-food franchises. This shift moves money away from “building things” and toward “picking the next man’s pocket,” as some critics put it. This creates a friction point where the wealth generated in the financial chunk doesn’t necessarily trickle down to the labor or service chunks.

How AI is Redefining Economic Chunks

You can’t discuss the chunks of the economy nyt without addressing the “AI elephant” in the room. As of early 2026, artificial intelligence is no longer just a sub-sector of tech; it is an infrastructure layer affecting every other chunk.

-

Labor Market Disruption: In the service and administrative chunks, AI is automating tasks that previously required millions of man-hours.

-

Capital Concentration: Massive amounts of venture capital are flowing into AI, often at the expense of traditional infrastructure or green energy projects.

-

Productivity Gaps: The “AI-enabled” chunks of the workforce are seeing significant gains in efficiency, while the “non-digital” chunks are struggling to keep up with rising costs.

Trade Wars and the “Hydra” of Supply Chains

According to recent reports, the trade landscape in 2026 is like the myth of the Hydra. As soon as one supply chain issue is resolved, two more grow in its place. This specifically impacts the chunks of the economy nyt that deal with physical goods—automotive, electronics, and consumer hardware.

The shift from “just-in-time” inventory to “just-in-case” resilience has made these chunks more stable but significantly more expensive. For the average consumer, this translates to higher prices for everything from dishwashers to smartphones, as companies bake the cost of “resilience” into their retail prices.

The Role of Private Credit and Shadow Banking

One of the most opaque chunks of the economy nyt has covered recently is the rise of private credit. As traditional banks have tightened their lending requirements due to higher interest rates and stricter regulations, private credit firms have stepped in to fill the void.

-

Higher Risk: These loans are often made to companies that might not qualify for traditional bank loans.

-

Lower Regulation: Because they aren’t “banks” in the traditional sense, they avoid many of the safety nets required by the Federal Reserve.

-

Interconnectivity: A collapse in this chunk could lead to a “cascade of insolvencies” that eventually hits the broader financial market.

Consumer Sentiment in a Fragmented Economy

How does the average person feel about these chunks of the economy nyt? Paradoxically, while the Dow may hit record highs (surpassing 50,000 in early 2026), many individuals feel a sense of “precarity.” This is because the chunks of the economy that are “winning”—like high-tech and private equity—don’t always provide the stable, mid-level jobs that the “losing” chunks once did.

The “vibecesssion” remains a real phenomenon. Even if the GDP grows at a moderate 2.1%, the feeling of being “left behind” by the faster-moving chunks creates a political and social divide that further complicates economic policy.

Conclusion: Navigating the Chunks

The reality of 2026 is that there is no “single” economy. There are only chunks of the economy nyt readers must navigate with a keen eye for detail. To thrive in this environment, investors and workers alike must identify which “chunk” they belong to and understand the specific risks—be it AI automation, trade tariffs, or financial over-leveraging—that govern that space.

Actionable Insight: Diversify your skills and investments across multiple chunks. Don’t rely solely on the “booming” tech sector, as it is the most prone to speculative bubbles. Instead, look for value in the “resilient” chunks of the economy that provide the essential infrastructure and services the world cannot function without.

Frequently Asked Questions (FAQs)

1. What does “Chunks of the economy” actually mean?

It refers to the different sectors or segments of the financial world (like Tech, Manufacturing, or Finance) that are currently performing at wildly different rates, often creating a fragmented economic experience for the public.

2. Why does the NYT focus so much on the “perpetual motion” of the economy?

This concept emphasizes that the economy relies on the constant flow of money between people. If one major “chunk” stops spending (e.g., during a pandemic or a financial crash), it triggers a chain reaction that hurts everyone.

3. Is the AI “chunk” of the economy in a bubble?

Many analysts worry that because AI value is often based on “future expectations” rather than current profits, it mirrors the speculative behavior seen in the 2008 financial crisis or the dot-com bubble.

4. How do trade tariffs affect the different chunks?

Tariffs primarily hit the manufacturing and retail chunks by increasing the cost of raw materials. This can lead to “cost-push inflation,” where companies pass those higher expenses on to you.

5. How can I protect myself from a crash in the financial chunk?

The best defense is a balanced portfolio and a “resilient” career path. Focus on sectors with “tangible” value—like healthcare, infrastructure, or essential services—which tend to be less volatile than speculative finance.